The goal of checking coin price movement is to find out the current value. It also means deciding on the possibility of this value growing in the future.

The coin-collecting market acts like an investment area. This area follows the basic rules of supply and demand.

These rules connect strongly to historical events. They also connect to collector interest and the coin-making methods.

Guessing future prices of the coins worth money needs a careful step-by-step method. This method builds on studying real facts instead of just feelings or hopes.

Simple Facts That Create Coin Value

Before starting to check price movement, people must understand the simple things that create a coin’s basic value. This value forms where the coin’s rarity, its physical condition, and the level of collector interest meet.

Rarity

The coin’s initial number, called the mintage, acts as the first sign of how hard it is to find.

The actual number of coins still existing today in a good state for collections is more meaningful.

A coin was first made in large numbers.

It was later melted down because of history. This coin can be harder to find than a coin initially made in small numbers.

Condition

The coin’s physical state is decided by the grading process. This process uses the standard Sheldon scale, running from 1 to 70.

Just one point difference in the grade can cause the coin’s worth to change many times.

An example is moving from MS-65 to MS-66. High levels of preservation are necessary for collector-investors.

These levels are MS-65 or better. Those coins are most steady against market ups and downs. They have the biggest chance for value growth.

Demand

A collector’s interest depends on how popular the coin series is. It also depends on its history and the picture it shows.

Coins connected to well-known historical people or big events often attract a larger group of collectors.

These people are ready to pay a higher price. Worldwide interest helps the coin be easily bought and sold. It also keeps its price steady.

Material

The amount of costly metals inside the coin, such as gold or silver, sets the lowest price the coin can have. This is its worth as just metal.

The numismatic premium is the extra cost collectors pay above this metal price.

A larger premium means the coin’s value comes more from its history and collecting interest.

It comes less from the raw materials it contains.

Finding Facts for Analysis

A good price check needs people to have access to the fullest and truest information. This information is about past sales.

Auction catalogs act as the main source of information. People need to gather details about the final sale price, the date it sold, the coin’s grade, and its main features.

Watching sales at large world and national auctions gives a wide base of facts for checking.

- Reports from grading services, like PCGS or NGC, offer numbers. These numbers show how many coins are officially graded at each level.

This data lets people truly see how rare the coin is in the best states of preservation.

More certified examples in a high grade could cause the price paid for rarity to drop. This then affects the future price forecast.

Coin price indexes are combined numbers. They follow the average cost for a group of favored coins.

They are helpful to judge the market’s overall health and its long-term ways of moving. These indices do not give small details about one specific coin.

Private buying and selling by dealers is often not public. It can still show current interest. Watching big coin shows and talking to experts helps people sense the market’s feelings. These feelings are not always shown in the public auction data.

Checking Price Movement

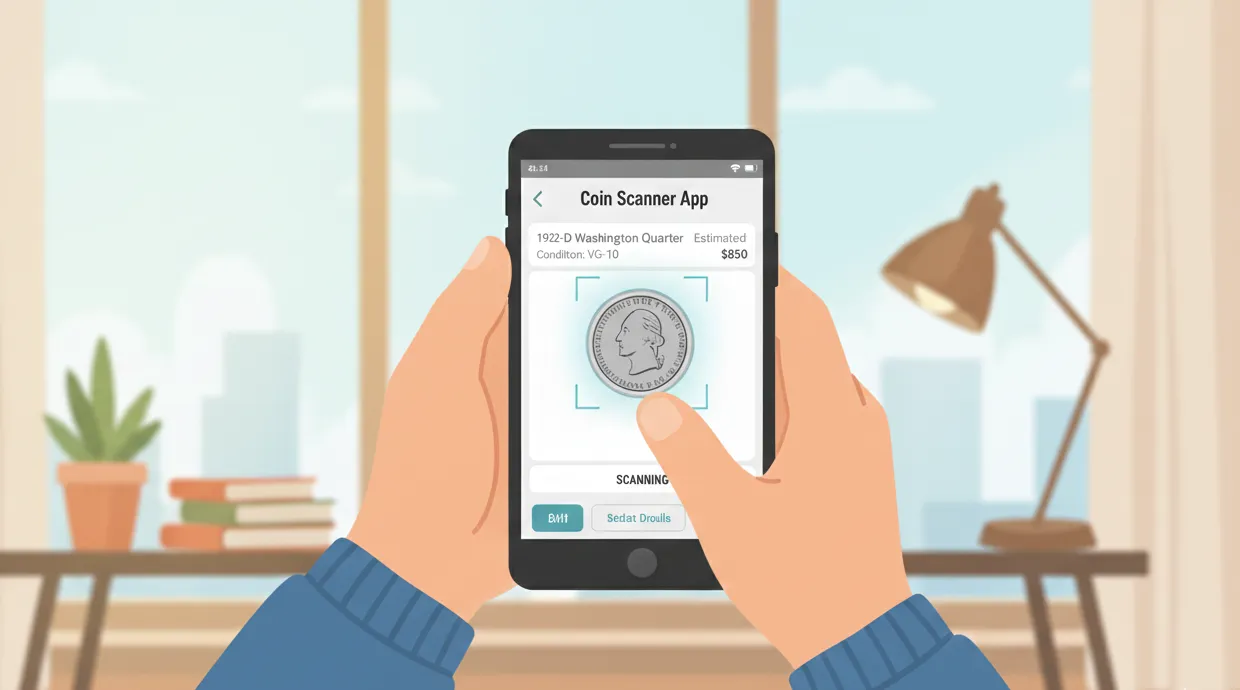

Checking the price with a coin scanner movement means looking at how prices have changed in the past. This helps people find repeating patterns and guess what will happen in the future.

Building Price History

People must collect the history of sales for a particular coin. This coin must have the same grade. They gather data for a long period, maybe 10 to 20 years. This data helps build a price series over time.

This series allows people to see if the price growth looks like a straight line. They can also see if it grows very fast or moves in repeating cycles.

Checking by Grade

Analyzing prices must happen separately for every grade. Lower-grade coins often show moderate and stable growth.

This growth keeps pace with rising living costs. High-grade coins (such as MS-67) can show sudden and fast growth.

This growth happens because their number is fixed. Collector-investor demand keeps going up. The main chance for investment value to increase is hidden in these best-preserved examples.

Using Moving Averages

People use moving averages to make short-term price changes less rough. Examples are 5-year or 10-year lines.

The coin’s actual price staying above the long-term average can signal a strong rising price movement.

The price falling below the average may show a price correction or a change in the overall movement.

Checking Sales Volume

A rising price sometimes comes with more sales volume. This means more deals are happening.

This proves that the price movement is strong. It also shows that the market has high interest.

A price rise with fewer sales may be less solid. This could point to market playing or a lack of coins being offered for sale.

Methods for Price Guessing

Guessing future prices in coin collecting is not an exact science. People can base their predictions on sensible conclusions. These conclusions come from the facts they have collected.

Comparing with Similar Items

The coin being looked at might be one of a kind or hard to find. Its future price can be guessed by looking at similar coins.

- These similar coins have already reached their highest prices.

- People must find a coin having a similar number made, a similar grade, and a similar place in history.

If a similar coin is worth twice as much, this difference can show the chance for price growth in the coin you are holding.

Checking the Collection Market

People must follow common changes in public interest. These changes could affect how many people want the coin.

The appearance of new large collectors could cause prices to go up quickly. A shift in focus toward a certain time period could also do this.

A successful movie or book about a past event can make people more interested in coins from that same time.

Estimating the Price Limit

Every kind of coin or series has a price limit in history. This limit is decided by the largest sales in that group.

People can check how far the current price is from this limit. This helps them guess the chance for short-term growth.

If the coin is already close to its highest past price, further increases will likely only happen because of the general market growth. It might also happen due to rising living costs.

Straight-Line Guessing

The simplest way is called linear extrapolation. This acts on the idea that the future price will keep going up at the same speed as in the past.

- For example, a coin grew by 8% each year for 15 years.

People can guess a similar growth for the next 5 years. This guess only works if the basic facts about the coin do not change.

This method is basic and needs to be checked and fixed often.

Special Things That Cause Faster Growth

There are special things that can cause the coin’s value to grow faster than normal. This growth does not follow a straight line.

- Error Type: Some coins have mistakes made during the production process. For these coins, the value is fully set by the kind of mistake and how unique it is. Big mistakes are easy to see, such as double printing. These are more valuable than the small ones.

- Authenticity Confirmation: Having an official paper from a top grading company instantly makes the coin easier to sell. It also raises the price. Not having such an official paper causes buyers to feel unsure. This doubt then causes the coin’s price to drop.

- Public Attention: A coin that suddenly gets the attention of large news companies always shows a quick jump in price. This attention is often linked to finding a hidden treasure. It might also be linked to a big court case about the coin.

- Event Connection: Events connected to the coin’s subject can cause a short-term price rise. For example, a coin is about the Olympic Games. A price rise can happen when the Olympic Games are held in a country where the coin is rare.

- Economic Facts: The economy can sometimes be uncertain. Living costs may rise quickly. During these times, people usually put more money into physical things like gold and rare coins. This action leads to price increases. Rare coins are thought of as safe things to own.

What an Investor Should Do

Successful guessing and investing require people to be careful. They must plan for the future over a long time.

People should spread their collection money. They should not put all their funds into just one coin or one type of coin.

They should distribute the money among different countries, past times, and metals. This lowers the danger connected to interest in one part of the market suddenly falling.

Coin collecting is a market for investing over a long time. This is usually 10 years or more. Short-term buying and selling of high-grade coins might make money. But this brings high costs with it.

Examples are auction fees and grading costs.

People must check auction results often, or at least with a free coin value app. They should do this at least once every three months. They must compare these results with the price guesses they made.

If a coin does not grow as hoped, they must change their guess. They must then decide what to do next.

Talking regularly with professional coin dealers and experts is a good idea.

They have secret information about the market’s wishes, coins for sale, and the general mood. These things are not always easy to see in public data.